The Way to Financial Freedom Part 4

In my previous essay, The Way to Financial Freedom Part 3, I indicated that understanding what is going on in the financial and technological worlds can help you better grasp our current predicament and how to escape it. The first article to discuss finance is the one you're reading right now.

The Importance of Understanding Cash Flow

Cash flow is the key phrase in the financial world. Blockchain is currently the most significant development in technology. If you have the prior preparation I described as a hypothetical situation in my first post on this series along with the willingness to take the risk, then understanding these two and how they work together to offer an alternative to our existing system can show you the path out of financial jail.

Let us start with cash flow.

The person who enlightened me about the importance of cash flow is the least that you will expect for he is not a theological educator. Instead, he is a Japanese American businessman who co-authored a book with the then-president of the United States, Donald Trump sometime in 2009. His name is Robert Kiyosaki. What I admire about this man is that though he is known as a financial educator, he acknowledges his limitation when it comes to technology.

For Robert Kiyosaki, cash flow is the most important word in business. For us to understand cash flow, we need to make three necessary distinctions.

First, the cash flow of an individual is different from the cash flow of a corporation.

For any aspirant investor in a specific company or a trader in a specific stock, studying the cash flow statement of the company is very important. This is part of due diligence in the world of investment and stock trading for by doing this, you will determine the financial soundness of a company.

Any aspiring investor or trader must study three important financial statements of the company he is planning to invest in or trade with. These are the Income Statement, Balance Sheet, and Cash Flow Statement. In the Cash Flow Statement, you will see the amount of cash generated by the company in operation, cash earned or spent on financing, and cash used in investing. Such corporate idea of cash flow is defined as:

the total amount of money being transferred into and out of a business, especially as affecting liquidity.

Second, what I mean by cash flow in this article is not the corporate kind, but personal cash flow, which includes understanding both Income Statement and Balance Sheet. (See Figure 1).

Understanding the relationship between these two financial statements is the key to sound management of personal finance to achieve financial freedom. Interpreting cash flow from this perspective refers to the direction of money, the inflow, and outflow, or the pattern of earning and spending. From the point of view of personal finance, this kind of cash flow has three patterns depending on people’s socio-economic class.

Figure 1 – Income Statement and Balance Sheet

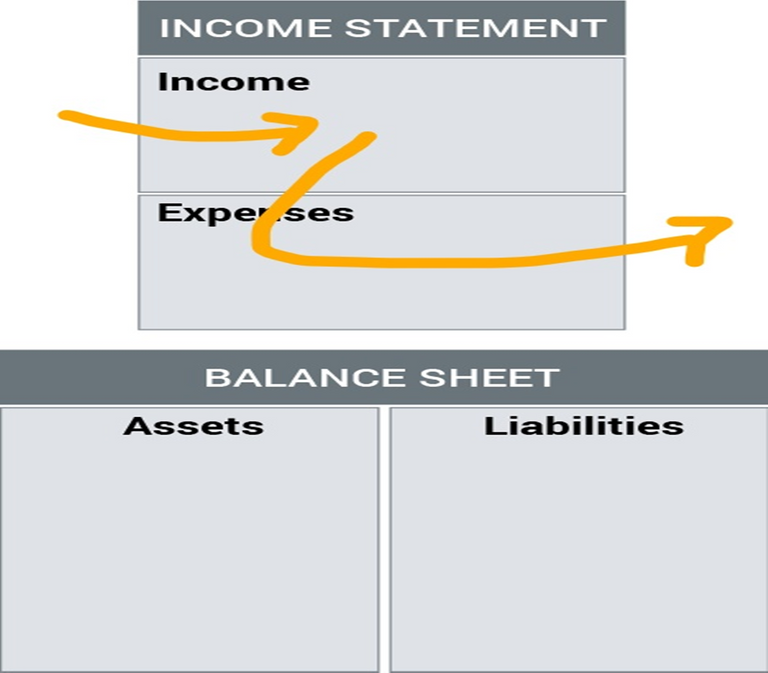

Figure 2 – Cash Flow of the Poor

Most poor do not see the importance of a Balance Sheet. Their cash flow is defined by their Income Statement, that is, they simply spend what they earn.

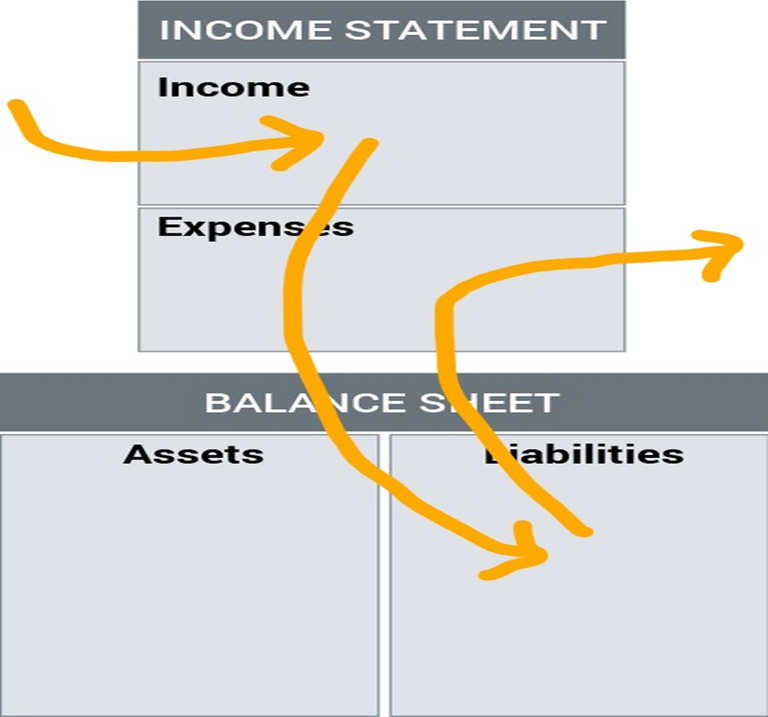

Figure 3 – Cash Flow of the Middle Class

Since the middle class is typically known as a social class, which income is gradually increasing due to success in small business or job promotion, they usually use their income by buying a lot, building a house, and purchasing furniture and other luxuries. Applying such cash flow to the mentioned financial statements would mean that they used their income buying liabilities and so their expenses increased together with their salary.

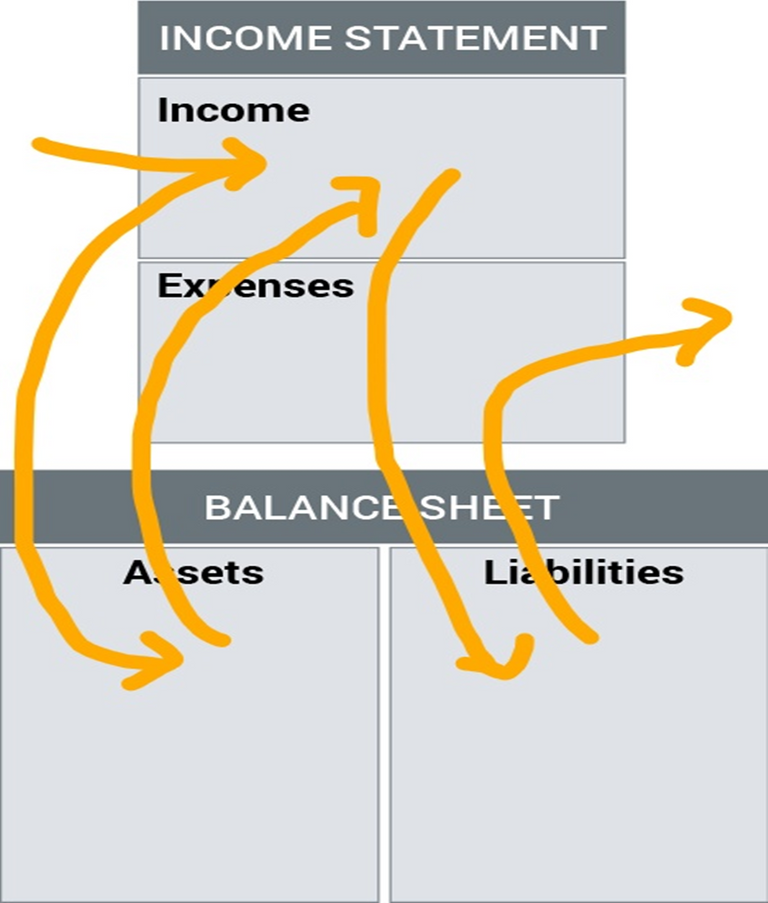

Figure 4 – Cash Flow of the Rich

In the case of financially educated rich, their cash flow is characterized by a focus on buying assets. As they continually use their income to add more assets to their Balance Sheet, their income grows. And when their income is big enough, that’s the time they use their money to spend for their liabilities.

The above paragraph that explains the three types of cash flow gives us also three definitions of cash flow, which are different from the corporate cash flow statement:

the direction of money from income to expenses,

the direction of money from income to liabilities to expenses, and

the direction of money from income to assets to income to liabilities to expenses.

The third way to understand cash flow is through the board game created by Robert Kiyosaki.

For Robert Kiyosaki, understanding cash flow is very important and that is why he gave his board game this name. Making this board game is his way to teach financial education to prepare people for the world of business and investment. Doing this, he made financial education his business. In this board game, cash flow is defined as income minus expenses. So, all in all, we have at least three concepts of cash flow:

corporate cash flow statements

cash flows of three socio-economic classes, and

cash flow as used in a board game

In the introduction of Kiyosaki’s book, Rich Dad Poor Dad, he mentioned a story of the different reactions of people as they played the board game: the accountant, the businessman, the computer programmer, and the banker.

The accountant finds Cash Flow a very interesting game making accounting and investing fun and exciting. While playing the game, she was disturbed with the fact about the ignorance of most adults about the basics of simple accounting and investing. She realized that ignorance of this subject was the primary reason why most people struggle financially.

The businessman on the other hand said that he does not need the game for he could hire professionals such as accountants, bankers, and lawyers to do the work for him.

And then we have the computer programmer. He was also not impressed for he believes that all he needs is software to teach him how to invest.

And then finally, the banker. He was moved while playing the game. He realized that he studied all this stuff in school but he does not know how to apply his knowledge in the actual world of business and investment. With that realization, he saw the need for him to get out of the Rat Race.

The rat race is a financial condition of a person where the cycle consists in working, receiving a salary, and spending. Such a cycle is repeated for years until the person reached the peak of his working years and in old age will rely on his relatives or friends for his hospital bills. This is how Robert Kiyosaki describes the rat race:

If you look at the life of the average educated, hardworking person, there is a similar path. The child is born and goes to school. The proud parents are excited because the child excels, gets fair to good grades, and is accepted into a college. The child graduates maybe goes on to graduate school and then does exactly as programmed: looks for a safe, secure job or career. The child finds that job, maybe as a doctor or a lawyer. . . Generally, the child begins to make money, credit cards start. . . and the shopping begins . . .

Having money to burn, the child goes to places where other young people just like they hang out, and they meet people, they date, and sometimes they get married. Life is wonderful now, because today, both men and women work. Two incomes are bliss. They feel successful, their future is bright, and they decide to buy a house, and a car…and have children…The happy couple decides that their careers are vitally important and begin to work harder, seeking promotions and raises. The raises come, and so does another child and the need for a bigger house. They work harder, become better employees, and even more dedicated. They go back to school to get more specialized skills so they can earn more money . . . Their incomes go up . . .They get their large paycheck and wonder where all the money went . . . The children reach 5 or 6 years of age, and the need to save for college increases as well as the need for their retirement.

That happy couple, born 35 years ago, is now trapped in the Rat Race for the rest of their working days. They work for the owners of their companies, for the government paying taxes, and for the bank paying off a mortgage and credit cards.

Then they advise their children to ‘study hard, get good grades, and find a safe job or career.’ They learn nothing about money . . . and work hard all their lives. The process repeats into another hard-working generation. This is the ‘Rat Race.’ (Source: Robert T. Kiyosaki, Rich Dad, Poor Dad).

From the above description of the rat race, I see it as a kind of prison though different in degree compared to the kind of economic and financial jail based on the existing monetary system. Understanding both cash flow and the rat race, I hope that you will explore the path to achieve such a vision of financial freedom.

In the next article, I will be giving an overview of my current understanding of blockchain technology.

https://leofinance.io/threads/rzc24-nftbbg/re-rzc24-nftbbg-2g87hjwyb

The rewards earned on this comment will go directly to the people ( rzc24-nftbbg ) sharing the post on LeoThreads,LikeTu,dBuzz.