How Do People Respond When They Need Money?

How do people respond when they need money?

Yes, prayer is given. But after prayer, what’s next? What is the appropriate action to address the need for money?

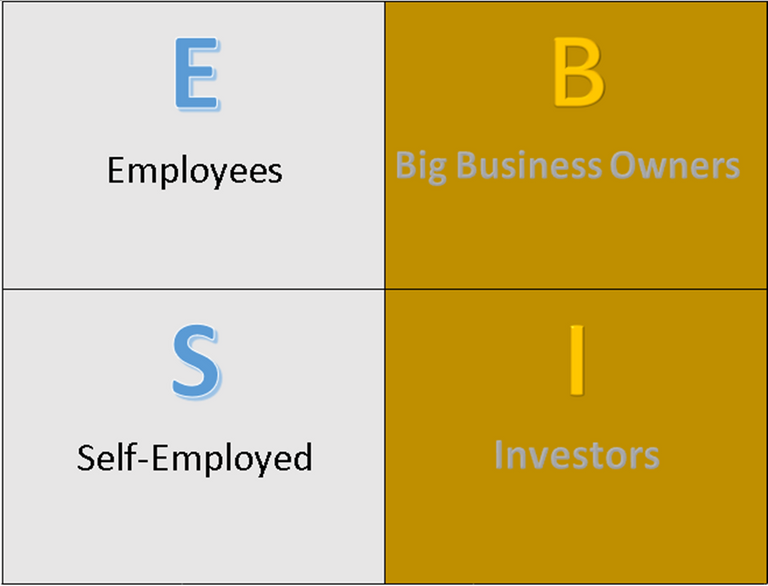

The Cashflow Quadrant

In his book Cashflow Quadrant, Robert Kiyosaki answers this question and informs us that people's response to the need for money depends on which quadrant an individual is coming from.

In his system, there are these four smaller squares within the bigger square that he calls the quadrant. Each small square represents a mindset, a character, a worldview, and a personal monetary operating system that determines one’s output. Let me give you an overview of these four quadrants.

E represents the employees. S is the quadrant of the self-employed, the specialists, and the owners of small businesses. B also represents business owners, but the primary difference from S is that the B business owners have a system to run their business whereas the S business owners want to be in control of running their businesses. Later, we will see the difference between these two. Finally, the I, represents the investors.

The Goal in Understanding the Cashflow Quadrant

The goal in understanding this quadrant is for you to identify which quadrant you belong and then if you aim to transfer the quadrant, you must possess the necessary mindset and attitude about money.

Before we proceed to the details of how people in each of these quadrants respond to their need for money, it is noteworthy to say right now, that for the E and S quadrants, their primary core value is one of security whereas the B and I aim for freedom.

The E Quadrant

If a person comes from the E quadrant, the quadrant of employees, the usual response when they need money is to look for another job or a job with higher pay. For an employee, the important things are job security, a higher salary, and other employment benefits. The difficulty in the E quadrant is that a job is just a short-term solution to a long-term problem. After productive years of employment, as time runs out and a person begins to age and realizes that he saves nothing for his retirement, then fear for his future starts to occupy his mind.

The S Quadrant

Second, a person coming from the S quadrant, the quadrant of specialists, self-employed, and owners of small businesses will respond to the need for money by doing their own thing ALONE. People in this quadrant want to take control of their situation on their own. The song “My Way” by Frank Sinatra is an appropriate theme song for them. The success of either their work or their business depends on their exceptional skill and physical presence. Once they leave their business to somebody else, problems begin to occur for none can do their task better than themselves. Robert Kiyosaki identifies that the S quadrant is the hardest of all for success in this quadrant would mean more time and more energy to spend. And that would also mean depriving your family of your time and physical presence.

The B Quadrant

Third, people from the B quadrant would respond to the need for money by either creating or buying a business system that will produce their cash with or without their physical presence. During the initial stage of the business, hard work is required. But as years pass by and the business becomes successful, freedom of time and money are the rewards that people in the B quadrant would enjoy. They can now freely use their time to have fun with their family, do the things they love, and serve humanity. Robert Kiyosaki claims that there are three types of business systems in the B quadrant. These are the traditional C-type corporation, franchising, and networking. In a C-type corporation, you develop your business system. In franchising, you buy an existing business system. In networking, you buy into and become part of an existing business system.

The I Quadrant

Lastly, people from the I quadrant, the quadrant of investors, respond to the need for money by looking for opportunities to invest in assets that produce money. Unlike in the first two quadrants where people work for money all their lives, people in the I quadrant have the skill to let money do the work for them. People investing their time to learn financial literacy will experience a discovery of entrepreneurial genius within them that will open their eyes to numerous opportunities almost everywhere, that ordinary people cannot see.

Transferring Quadrant

Transferring from the E and S quadrants to the B and I quadrants is not easy but the journey is worthwhile. Depending on the background, for some, the process would be easy but for many the journey is impossible. Kiyosaki describes the transfer as a kind of battle between who you are and who you want to become. It is internal strife within you seeking either security or freedom. He compares the transfer to “a drowning person beginning to fight for air, or a starving man who will eat anything to survive” (p.184).

It is true that the transfer is risky and that is why preparation is necessary. And the best preparation to transfer quadrant is through the study of financial literacy and financial technology including blockchain, cryptocurrency, and decentralized finance. As you view your life long-term, staying in the E and S is riskier than transferring to the B and I. The question is, when will you start your journey?

Hive and the B and I Quadrants

Revisiting this June 2011 article, I observe that there are some qualities in the B and I quadrants that you can find in Hive. If we see it this way, joining the Hive blockchain can be your first step in transferring from the E and S quadrants to the B and I.

I assume that many Hivers and Lions are now aware of the idea of Hive as a business. I think such a conviction is not wrong after all. Based on Robert Kiyosaki’s insights, we will find at least four things in the B and I quadrants that you can also find in Hive. And what are those?

One, work hard during the initial stage of building your Hive business and persevere after several years until you see your network and stakes grow, and that’s the time to reap your rewards.

Two, after several years of sowing, watering, and growing your Hive business, you will later enjoy your time and financial freedom. You can now freely use your time to have fun with your family, do the things you love, and serve humanity.

Three, on Hive there are so many micro opportunities where you can invest in digital assets such as the layer two tokens like $LEO, $CENT, $CTP, $SME, and others. For now, the return that these tokens give you is so small, but if you will keep doing these for years, provided that Hive will still be with us, this various layer two applications built on Hive will give you the cash that you need. In principle, the tokens working for you are no different from the idea of money working for you.

Finally, people investing their time to learn financial literacy and financial technology will have different mindsets and perspectives in life. Your eyes will be opened to diverse opportunities that the average person cannot see.

So, these are my bases for saying that if we will view Hive as a business, it is more proper to categorize it under the B and I quadrants. Yes, we know that nothing is certain in the world of financial technology such as cryptocurrency and decentralized finance. I wish I am not misled in having this hope. However, that’s my current view of Hive.

Grace and peace!

Note: This is the transcript I used in the 3Speak video where I talked about Hive and the Cashflow Quadrant.

Money is really vital thing in life.

https://leofinance.io/threads/rzc24-nftbbg/re-rzc24-nftbbg-2fwq1yogw

The rewards earned on this comment will go directly to the people ( rzc24-nftbbg ) sharing the post on LeoThreads,LikeTu,dBuzz.

As a guest curator for @ecency I accepted the boost to your article as it's a nice interpretation of different layers in the Hive ecosystem

Thank you! I am grateful that you appreciate my take on diverse front-ends built on Hive.

Yay! 🤗

Your content has been boosted with Ecency Points, by @rzc24-nftbbg.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more