BTC Price, FOMC, and the Argentinian Government

The recent rise in the price of BTC excites many. Analysts respond by giving updates to explain the explosion in price.

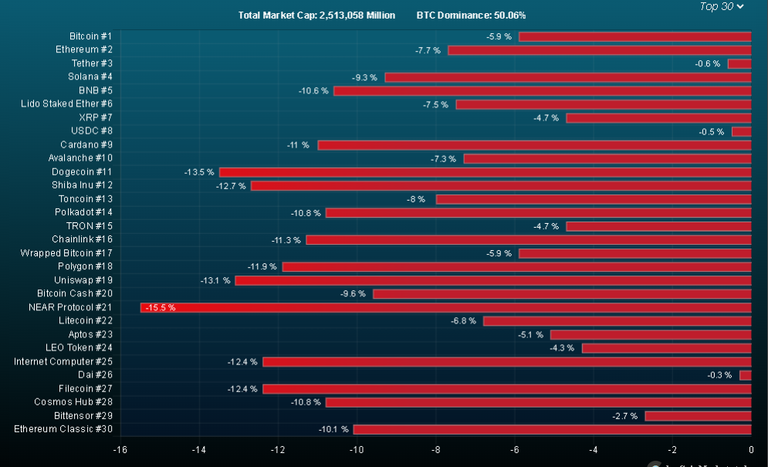

Now that the price of BTC is pulling back, as expected, analysts and writers have to find stories to justify such a crash. In reading articles from coinmarkets.today, I found different versions to explain the decline

The first one is about a single large fund that shorted MicroStrategy and bought $1 B worth of BTC. Source

I have difficulty accepting a “crash” story due to two reasons:

One, it is considered a consensus among analysts that a market cycle consists of four stages: expansion, bubble, crash, and depression. If the current setback in BTC’s price is a crash, does it mean that the prior rise was a bubble?

I think “crash” is a heavy word and still too early. I prefer to see the price decline as a temporary pullback preparing for another massive run.

Two, though many will buy the shorting story of a large fund, I think such a pullback in BTC’s price is healthy and should be considered as a buying opportunity.

Remember that the current “Red Sea” that we see in the market is different from the metaphorical phrase “blood on the street.” This one might be caused by short-term profit-takers and is a healthy pullback. Source

The other one refers to a chaotic situation in the financial markets characterized by panic selling resulting in widespread heavy financial loss.

Another factor that aggravates the price decline of BTC price is the selling pressure coming from smaller investors described by Valeria Blokhina as “shrimps, crabs, and fish.”

Closely connected to the BTC price story is the upcoming interest rate announcement by FOMC. This is another exaggerated report that alarmists enjoy. It was believed that the decision of the Fed would affect financial markets including the price of BTC. If this is the case, the FED will find a confirmation of its almighty power to determine the direction of the financial markets. Source

Lastly, though not connected to the BTC price, this time it’s about a law to create a registry for cryptocurrency service providers regulated by a government agency. How should the cryptocurrency space respond to this kind of announcement from the Argentinian government? Should we celebrate anticipating that mass adoption is near? Or should we lament that the technology designed as a replacement for the established financial system will now be in the hands again of the gatekeepers?

Enhancing transparency and combating money laundering are the selling points of the Argentine Senate in making this new law attractive to the public. Only the clueless will buy such a crap. Source

Posted Using InLeo Alpha