Breaking Down Barriers: How Tokenization is Making the World a More Inclusive Investment Playground

I first read about the idea of the end of Wall Street in August 2021 in the book The Wall Street Era is Over: The Investor's Guide to Cryptocurrency and DeFi, the Decentralized Finance Revolution. I read this book several times. At first, I hardly understood anything because all the vocabularies used by the writers were new to me. When I re-read the book the second time, I understood 10%. The third time I read after a few months of experience with Hive, I can say that I understood about 40% of the book's content.

It is only natural for a beginner entering the crypto field to look for a guide. I used the book as a benchmark in evaluating crypto projects. Perhaps this is one of the reasons why I have avoided the scams that have plagued the crypto space.

After almost three years, I could say that the book's content is conservative and safe for beginners. However, there is no substitute for learning from experience, reading white papers, and interacting with those who have entered cryptocurrency and decentralized finance.

Now that Wall Street has entered the ETF, I'm not sure if the writers are still convinced that the era of Wall Street is over. Or perhaps, Wall Street has already hijacked the crypto space by capturing the top two names via their ETF projects.

When it comes to the Decentralized Finance revolution, perhaps it has not yet been completely influenced by Wall Street although many these days love to use the word "DeFi" in their respective crypto projects.

This article looks more realistic. The writer did not say that cryptocurrency and DeFi will end the power of Wall Street. Instead, tokenization will "disrupt" the power of Wall Street.

Cloris Chen shared a study done last year that showed a significant increase in capital investment in digital assets and interest in tokenization. According to the report, institutional investors are gaining confidence in the long-term value of blockchain and digital assets.

It's nice to know that institutional investors are not only interested in digital assets, but they already have a clear strategy on how to do it. One of them is to tokenize their assets by partnering with crypto companies.

Interesting! What's going on in the minds of the fund managers of these institutions that they thought of tokenizing their assets? What are the advantages they see that caused them to tokenize their assets?

One of the attractive ideas behind tokenization is the concept of inclusivity. This idea does not refer to providing access to ordinary people. Instead, what is meant by inclusivity in the article is the variety of assets that can be tokenized. This includes "real estate, art, bonds, equities, intellectual properties, and even identity and data." It is said that precious metals such as gold can also be included in the assets that can be tokenized.

This message has been repeated many times by @taskmaster4450 in his writings. It is interesting to think that this view, which is already prevalent on Hive is getting confirmation from the lips of institutional investors.

I have no problem emphasizing the diversity of assets in the term "inclusivity." However, here at Hive, whenever inclusivity is mentioned, it is first and foremost applied not to assets but to ordinary people, those who do not have access to traditional banking, mostly from developing countries. I think it is good to emphasize this as the primary meaning of the term because banks and politicians often promise inclusivity but it is only good on paper and during political campaigns. When it comes to concrete implementation, they always fall short.

The CEO of Cogito Finance identifies numerous examples of how tokenization might be applied to gold and the arts. It's thrilling to consider that 50 investors may own an expensive piece of art by dividing its value into 4,000 tokens. Cloris even mentioned that a few well-known musicians are now embracing tokenization.

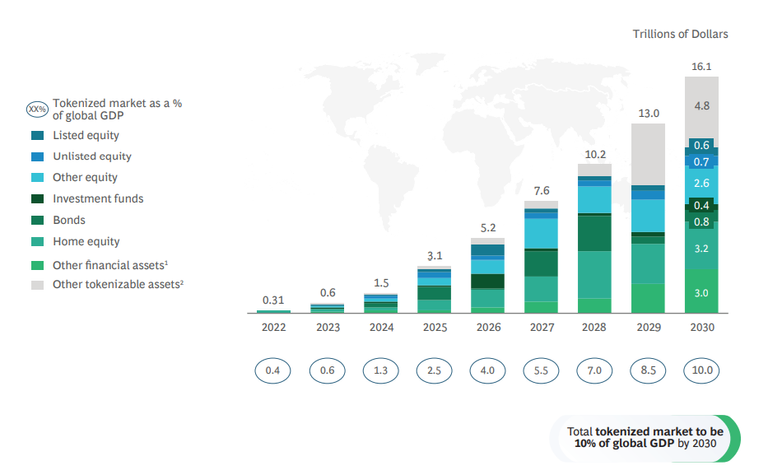

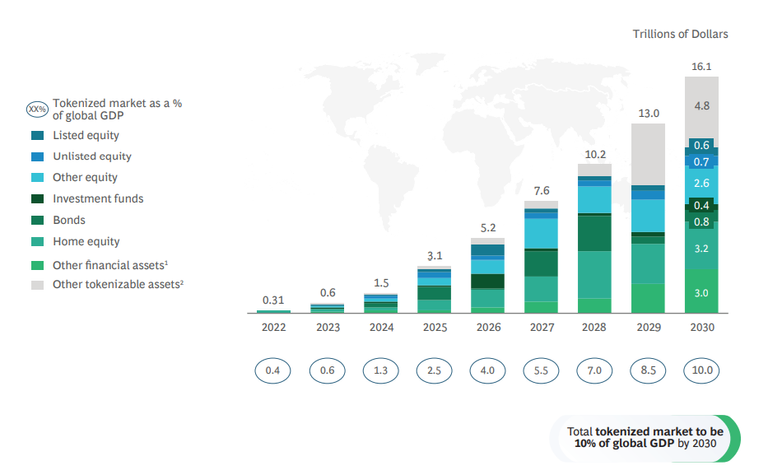

As this trend gains traction in the coming days, tokenization will transform real-world assets. The Boston Consulting Group projects that by 2030, tokenized assets will be worth 16 trillion USD.

Una kong nabasa ang pananaw na matatapos na ang kapangyarihan ng Wall Street noong Agosto 2021 sa aklat na The Wall Street Era is Over: The Investor's Guide to Cryptocurrency and DeFi, the Decentralized Finance Revolution. Ilang ulit kong binasa ang aklat na ito, Noong una ay halos wala akong maintindihan dahil sa bago lahat ang mga vocabulary na ginamit ng mga sumulat. Nang basahin ko uli ang aklat sa ikalawang pagkakataon, 10% ang naintidihan ko. The third time I read pagkatapos ng ilang buwan kong karanasan sa Hive masasabi ko na nasa 40% ang naiintindihan ko sa aklat na ito.

Natural lamang sa isang baguhan na papasok sa larangan ng crypto ang maghanap ng guide na gagabay sa kaniya. Ginamit ko ang aklat na ito bilang benchmark sa pag eevaluate ko ng mga crypto projects na nababasa ko. Marahil isa ito sa dahilan kung bakit nakaiwas ako sa mga scams na naglipana sa crypto space.

Paglipas ng halos tatlong taon, masasabi ko na ang nilalaman ng aklat ay konserbatibo at safe para sa mga baguhan. Wala pa ring kahalili ang pagkatuto mula sa karanasan, pagbabasa ng mga white papers, at pakikihalubilo sa mga aktuwal na pumasok sa cryptocurrency at sa decentralized finance.

Ngayon na nakapasok na ang Wall Street sa ETF, hindi ko tiyak kung kumbinsido pa rin ang mga sumulat na tapos na nga ba talaga ang era ng Wall Street o napasok na nila ang mundo ng cryptocurrency?

Pagdating sa Decentralized Finance revolution, marahil ito ay hindi pa lubusang naiimpluwensiyahan ng Wall Street bagamat marami ang gumagamit ng salitang DeFi sa kani-kanilang mga crypto projects.

Ang artikulong ito ay mas mukhang makatotohanan. Hindi sinasabi ng sumulat na wawakasan ng cryptocurrency at DeFi ang kapangyarihan ng Wall Street. Sa halip ay bubulabugin lamang ng tokenization ang kapangyarihan ng Wall Street.

Ibinahagi ni Cloris Chen ang isang pag-aaral na isinagawa noong nakalipas na taon na nagkaroon ng significant increase sa paglalagak ng kapital sa digital assets at interes sa tokenization. Ayon sa ulat, ang mga institutional investors ay nagkakaroon ng kumpiyansa sa long-term value ng blockchain at digital assets.

Nakakatuwang malaman na hindi lamang interesado ang mga institutional investors sa digital assets, sa halip ay mayroon na silang malinaw na strategy kung paano gagawin ito. Isa sa naiisip ng karamihan ay ang pagtotokenize ng kanilang assets sa pamamagitan ng pakikipagpartner sa mga crypto companies.

Nakapagtataka. Ano kaya ang pumasok sa isipan ng mga fund managers na ito at naisipan nilang itokenize ang kanilang mga assets? Anu-ano ang mga benepisyo na kanilang nakita na nagtulak sa kanila upang gawin ang bagay na ito?

Isa sa nakakahikayat sa tokenization ay ang konsepto ng inclusivity. Inilapat ang ideya na ito hind sa pagbibigay ng access sa mga ordinaryong tao. Sa halip, ang tinutukoy ng inclusivity ay yong lawak ng mg assets na pwedeng itokenized. Kasama dito ang “real estate, art, bonds, equities, intellectual properties, and even identity and data.” Maari din daw isali ang precious metals tulad ng ginto sa mga assetsna pwedeng itokenize.

Ang mensaheng ito ay paulit-ulit na binabanggit ni @taskmaster4450 sa kaniyang mga panulat. Nakatutuwang isipin na ang ganito palang pananaw na laganap na sa Hive ay nagkakaroon ng kompirmasyon mula sa mga labi ng mga institutional investors.

Ok naman na inuna ang diversity ng assets sa konsepto ng inclusivity. Dito sa Hive, tuwing mababanggit ang inclusivity, ito ay una at higit sa lahat ay nilalapat hind sa mga assets kundi sa mga ordinaryong tao, mga taong walang access sa traditional banking na karamihan ay nagmumula sa mga developing countries. Sa tingin ko magandang bigyang diin ang primary usage ng term na inclusivity na tumutukoy sa mga pangkaraniwang mga tao sa dahilan na ito kasi ang madalas ipinapangako ng mga bangko at mga politiko ngunit hanggang papel at kampanya lamang at laging kapus pagdating sa implementasyon.

Ang CEO ng Cogito Finance ay maraming binaggit na mga halimbawa sa artikulo kung papaano pwedeng itokenize ang ginto at arts. Nakakatuwang isipin na sa pamamagitan ng tokenization, ang art na napakamahal ang halaga ay maaaring ariin ng 50 investors sa pamamagitan ng 4,000 tokens. Dagdag pa ng sumulat na niyayakap na sa ngayon ng ilan sa mga tanyag na artists ang konsepto ng tokenization.

Sa pagdating ng mga araw, sa oras na ang trend na ito ay maging popular, babaguhin ng tokenization ang mga real world assets. Ayon sa Boston Consulting Group, aabutin ng 16 trillion USD ang halaga ng tokenized assets sa taong 2030.

Reference:

Tokenization empowers investors and disrupts Wall Street

Posted Using InLeo Alpha

There is a massive amount of money flooding in the global markets!

May I use your visual on a thread?

I'm tagging you on a thread. Please use #cent hashtag and join us 😉

Yes, sure Sir. It's from Boston Consulting Group.

!PIZZA

Do you mean in my post? Do I need to add #cent in addition to #HIVE-173575?

Make sure you add #cent for both LeoThreads and posts

$PIZZA slices delivered:

@rzc24-nftbbg(1/5) tipped @idiosyncratic1