Lessons on Tokenomics

I first read of this idea of $HBD as pristine collateral from @taskmaster4450, but it never sinks into my brain, not until I listened to the debate between @starkerz and Andrew Quinn.

I am referring to the 3Speak video I watched three days ago. @neopch recommended the video to me asking me if I am interested to study Hive and tokenomics.

I think the original debate has been divided into seven parts to make them more understandable. Watching a long video isn’t easy just like reading long articles. That’s why I think both microblogging and video reels and shorts are more appropriate at a time that people are bombarded with too much content.

In this article, I just want to review what I learned so far from listening to the debate and I also want to share the transcription of @starkerz's talk about $HBD as pristine collateral.

Overview of Insights

I listened to the entire series for the whole day. I made a couple of #threadstorm to share the insights I learned.

Andrew Quinn’s distinction between Hive as a product and Hive as an investment is not clear to me.

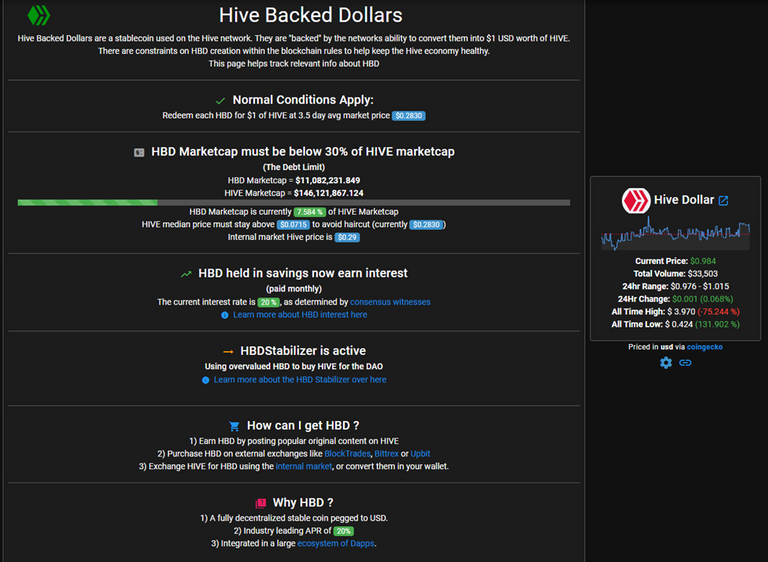

The distinction between $HBD as an algorithm-stable coin and other stablecoins that are backed by USD deserves an emphasis.

TCMD replied to a crash scenario objection by mentioning that Hive experienced such a case in the past twice and yet the community survived. This shows the strength and resiliency of the Hive network. I mentioned in my thread that I love resiliency as a description of Hive for:

. . . it refers to the ability of Hive as a community to withstand and recover from unexpected events. This shows that Hive can bounce back, adapt, and remain functional amid disruptions.

And then TCMD emphasized the importance of digital freedom and the priority of establishing a sustainable ecosystem. Hivers are reminded not to be concerned too much about the token’s price for once the network effect expands, the price will just naturally follow.

In the fifth part of the series, Andrew issued a kind of warning and narrated a story showing the unsustainability of a yield above market price. If I understand him accurately, I think he argues that during the early years of a project, one can possibly earn a higher yield, but such a yield can easily be wiped out without warning.

TCMD replied that the issue isn’t the sustainability of the 20% APR of $HBD though it is open to question. The real issue in the debate is $HBD having a 20% APR makes it a scam.

In the sixth part of the series, TCMD made a long closing remark. After negating the CEO and the centralized entity and emphasizing the importance of the community and the DApps, TCMD made this extended conclusion:

I see wells in Ghana, I see parks in Venezuela, I see politicians recognizing Hive, I see $HBD being used because of its fast and feeless nature, . . . I see social media accounts blowing up, and I see layer two’s being built up. And I never talk about the price because I have no control over that, and it's never a good thing you tell somebody, "Oh, this is going to go up in value." If it does, you get a high five and if it doesn't, you get a middle finger. I don't earn anything from a high five and I don't want a middle finger. So, you know, don't go out and buy $HIVE if you're expecting it to go up in price. But if you want to join an interesting community, if you want to be a part of true censorship resistance and be able to build immutable apps . . . I think Hive is a very cool place to check out and that's all I can say about Hive and that's my pitch for Hive.

Reaching the last part of the series, I came up to the conclusion that I cannot make a #threadstorm on @starkerz idea of tokenomics. He made a lot of points that I think deserve a transcription, so I went to Discord and asked his permission:

And this is his reply:

Transcript of Important Insights from the Concluding Video

Andrew Quinn clarified his stance:

I’ll just close out by saying that I have startup experience in my background. I know what it’s like to try to build something. It’s not easy. You have to risk things. You have to put yourself out there. To anyone who’s trying to do that, automatically, I respect you.

I think there’s a little bit of a perception formed that you know I’m a Hive hater. It’s not the case at all and I just want to be very clear that my original comment was specifically about 20% APR. I’m totally pro-Hive when it comes to products, use cases, and growing Web 3. It sounds awesome. I am on board with that.

However, I do have the reservation about the tokenomics and the high-interest rate, but I think we can distinguish between the two and I just want to make that clear to everyone before I close out.

And then here’s @starkerz’s response:

If you take the thing that Dan said particularly the 3.5-day window, it’s a big deal, it’s a big, big deal. There is no way what happened on LUNA would have happened with that 3.5-day window.

But the other thing that’s written well is what that does to us on Hive it makes us view HBD as pristine collateral. It will always give you one dollar worth of HIVE in the same way that cashing in a treasury bond will always give you one dollar worth of dollars.

So, what we’re going to do from that is basically make a layer-2 NFT system where you can stake an NFT for a certain number of days and it will give you an APR return. Now at the moment, we’ve got that 3.5-day window that gives you 20% APR. I personally believe that should be more like 2% APR but then with what we’re going to call time vaults where you expand the amount of time that you’re locked in just like a US treasury bond where you know you might get time vaults involved. So they’ve got 10-year lock-ins but for that 10-year lock-in, you get a much higher APR maybe more towards 18% or 20%. We’ll have to let the community and the witnesses decide what that’s going to be and let them do their economics on that.

And so, then you can take those NFT bonds that are locked into the system and guaranteed to provide you an APR and then use them as collateral to take speculative loans in the same that the Eurodollar system does. The difference is that this is all transparent and everyone can see what’s coming due at all times so that the liquid HBD that’s coming into the market that could potentially crash can be seen months and months ahead in a very predictive way, and so the witnesses can set their APR which is effectively the interest rate setting that the FED does except it’s all in transparent blockchain and the mistakes can’t be hidden like they are hidden in the Eurodollar system. And so, we think we have a really genuine shot at a truly decentralized ownerless Layer-1 collateral debt system here that can be used to provide collateralized loans.

Conclusion

Great series! Finally, I reached the end of the debate. Very educational. Now, I have an idea of how $HBD can follow the footsteps of the US treasury bond and the Eurodollar system.

Great to see this understanding spread ))

There is power in repetition and in using different mediums of communication and approaches. The long video didn't work for me, but the one made by @neopch is more digestible. Thanks!

https://leofinance.io/threads/rzc24-nftbbg/re-rzc24-nftbbg-31bziqsp2

The rewards earned on this comment will go directly to the people ( rzc24-nftbbg ) sharing the post on LeoThreads,LikeTu,dBuzz.

That's right! The original debate was almost 40 minutes so I have decided to split it to seven parts in a scheme "question - answer" so everyone can watch or listen to it like 1 per day or any other preference and there is also a full one. All of them you can listen to like a podcast :) soon on 3Speak we will be have Podcast option too as far as I know.

That's great! I prefer watching short videos. If I am not mistaken, I stumbled upon this content even earlier but due to its length, I was not able to complete it. However, when I saw the shorter versions, I listened to the first two videos and stopped. I continued listening to succeeding videos during my free time. I just didn't notice that I already reached the 7th one. Thanks again!