Collateralized Loans - The Catalyst for POLYCUB Moon

frens, the dust is starting to finally settle in the PolyCUB launch. We're 3 weeks in and the emissions have been slashed pretty hard.

xPOLYCUB Loans

If you haven't at least checked out PolyCUB, LeoFinance's lastest app... You are definitely missing out. They have changed the game with a DeFi 2.0 yield optimizer with daily airdrops back to the CUB holders on Cub Finance. The first 3 weeks of the launch have been a whirlwind with extreme volatility followed by a dump and then some sideways price action. The POLYCUB token is currently sitting around 75 cents and we briefly touched $10 million in Total Value Locked on the platform. That has since come back down to around $9.3 million, still a pretty staggering number for only 3 weeks. The marketing has really paid off and it created a kind of snowball effect for major crypto news outlets. @anomadsoul wrote a pretty amazing post highlighting this marketing snowball effect so I highly recommend checking it out. Click on all of the articles about PolyCUB and help get that SEO up!

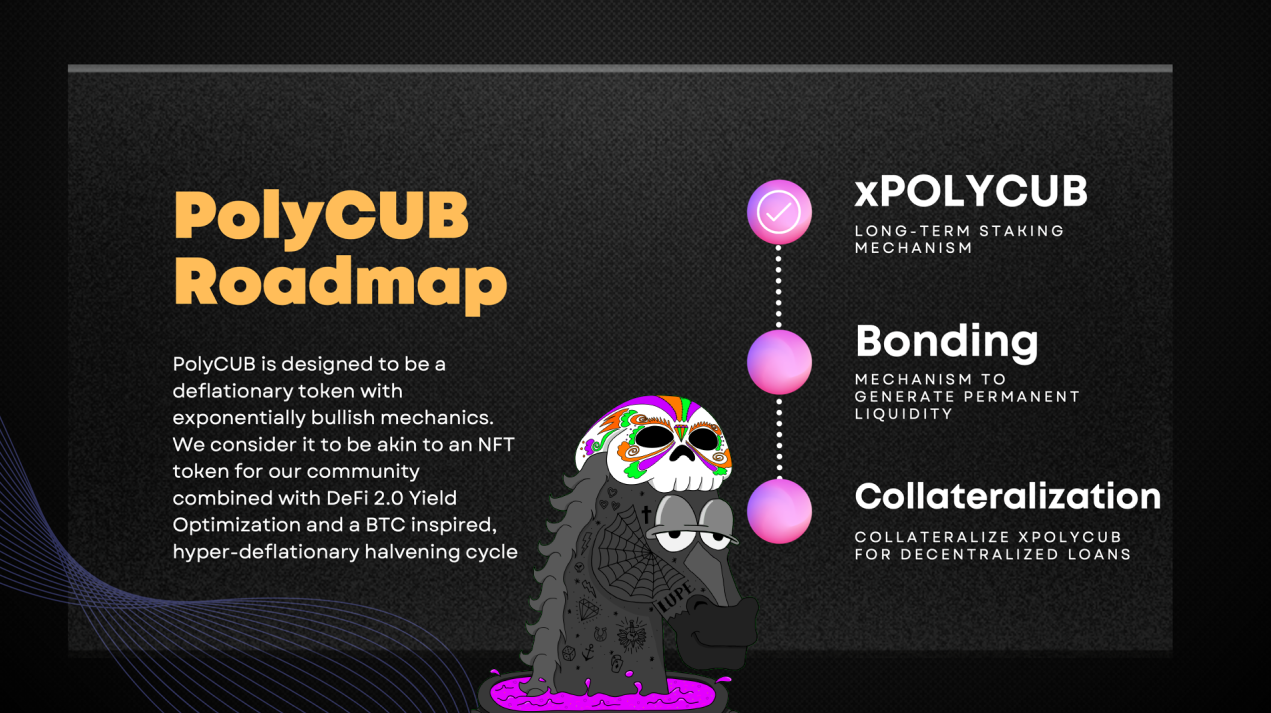

In a post yesterday from the LeoFinance team, they released a roadmap and announced an unexpected feature! We already knew that we were going to get a bonding feature that allows users to sell their LP tokens to the protocol in exchange for discounted POLYCUB. This is something that Khal has been talking about since the very beginning and arguably what's going to drive the most liquidity into the protocol. The amount of value locked in the xPOLYCUB single staking farm is pretty staggering as well. There's more value locked in there than all the farms combined - for good reason. The APY is pretty insane for anyone getting in now rather than later.

As Khal said, the best time to start farming POLYCUB was 3 weeks ago. The second best time to mine POLYCUB is now. There's an extremely limited supply around 7.2 million and now we're getting a feature that's going to create even more demand - over-collateralized loans. Users will be able to stake xPOLYCUB tokens in the Collateralized Loan contract and receive a loan in USDC that repays itself with yield from xPOLYCUB. This feature is going to launch in about a week, during month 2 when the emission rate gets slashed again down to 2 POLYCUB per block. This is going to drive even more liquidity into the xPOLYCUB vault because users are able to get liquidity without selling their xPOLYCUB tokens. They didn't give a ton of information as it's going to be pretty complex the way it works. We will have to wait and see.

I can only assume that there will be loan options for different time frames. As far as how much collateral you'll need, I'd bet over 150% of the loan amount you're taking. This protects the protocol liquidity and should serve as a way to take the loan with little to no interest. I personally don't feel that over-collateralized loans in DeFi should incur interest because you're already locking up more than you're getting. There have already been some really great posts about this new feature from way more intellectual Hivers than myself, so I won't try to break anything down and do math. I'm just here sharing my thoughts on the new feature. I think with the viral marketing and launch of bonding plus loans, we could see a massive influx of capital. So... The golden question is... wen moon? And the answer? soon.

Thanks for reading! Much love.

Links 'n Shit

| Play to Earn | Read emails, Earn Crypto | Get free crypto every day | Get a WAX wallet |

|---|---|---|---|

| Gods Unchained | ListNerds | PipeFlare | WAX.io |

| Splinterlands | GoodDollar | ||

| Rising Star | FoldApp |

Posted Using LeoFinance Beta

Yay! 🤗

Your content has been boosted with Ecency Points, by @l337m45732.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more